Taxes

- 18 Apr 2024

- 1 Minute to read

- Print

- DarkLight

Taxes

- Updated on 18 Apr 2024

- 1 Minute to read

- Print

- DarkLight

Article summary

Did you find this summary helpful?

Thank you for your feedback

The following steps will guide you through Blackthorn's official recommendation for handling tax/GST.

Please Read

If the checkout amount includes cents, i.e., $1135.66, there is a chance that the updates to the Unit Price, Tax Rate, and Total Amount won't round correctly. This can be fixed by adding additional logic to your trigger during updates and calculations. Please test your flow before using it.

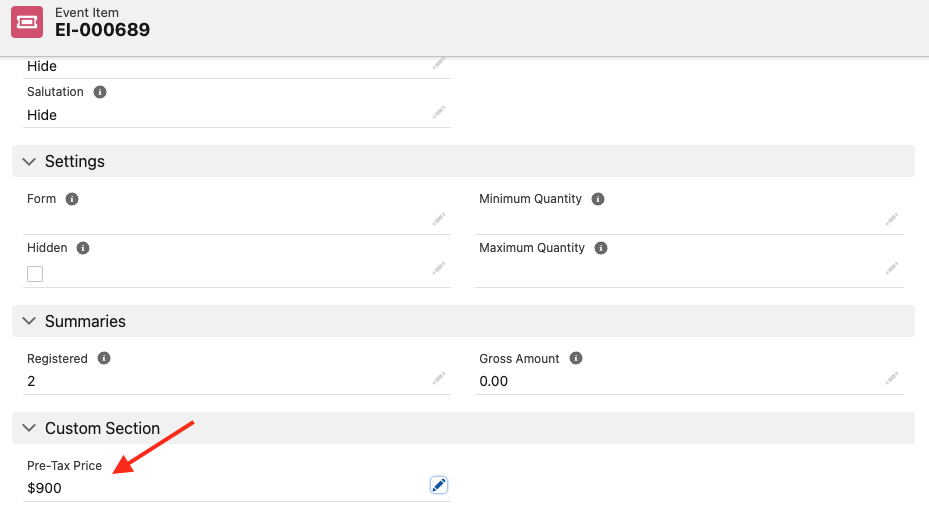

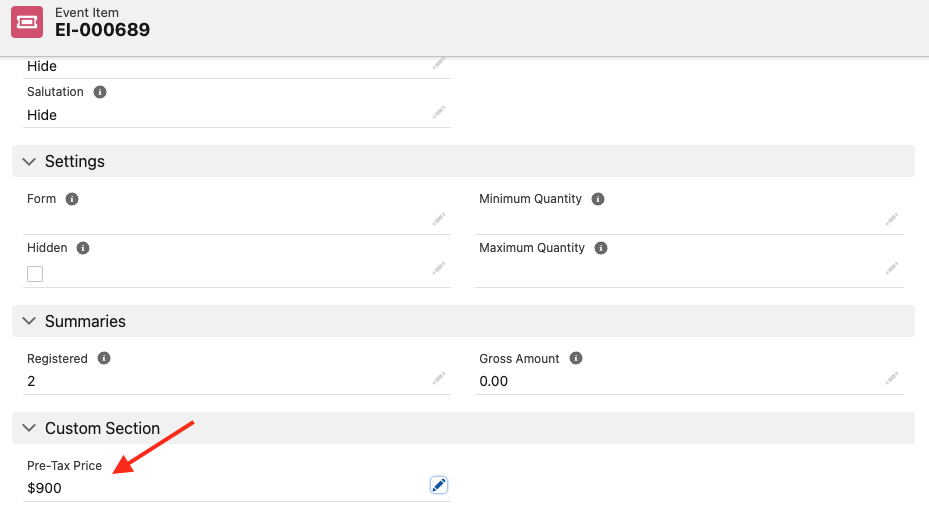

- Create a custom Pre-tax Price currency field on the Event Itemobject.

- Click the Gear icon.

- Click Setup.

- Click the Object Manager tab.

- In the Quick Find box, enter and click “Event Item”.

- Click the Field & Relationships tab.

- Click New.

- Check Currency.

- Click Next.

- Set Field Label = “Pre-tax Price”.

- Set Length = “16”.

- Set Decimal Places = “2”.

- Check Auto add to custom report type.

- Click Next.

- Review and update the permissions.

- Click Next.

- Check Event Item Layout to add the new field to the Event Item page layout.

- Click Save.

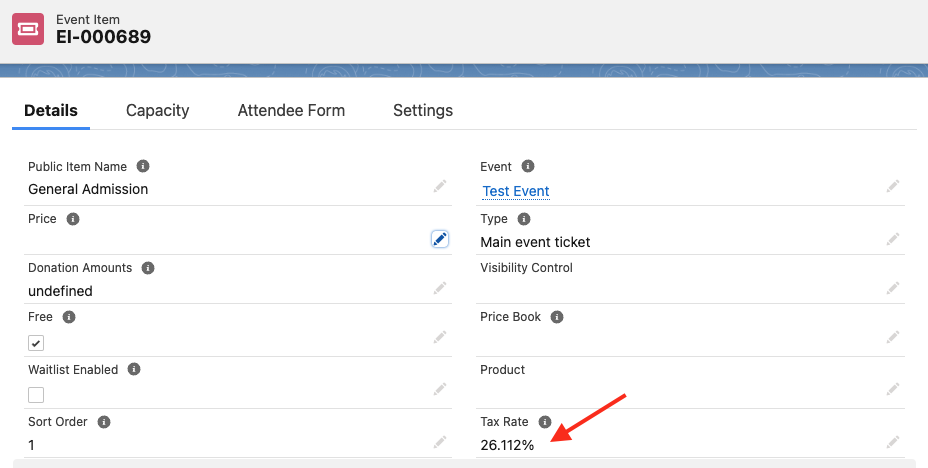

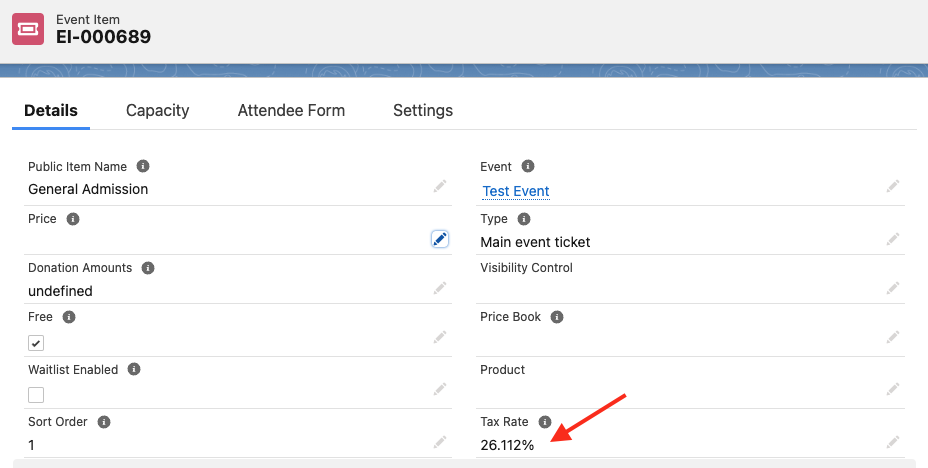

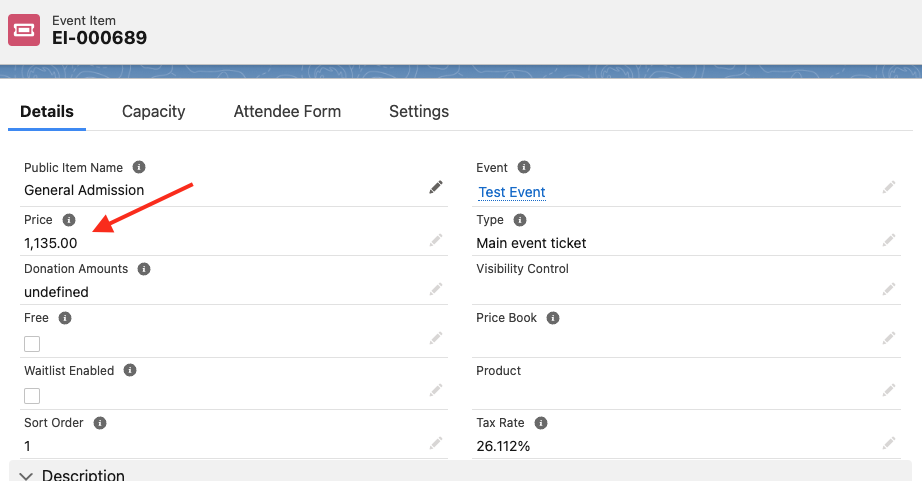

- Enter a tax rate in the Event Item Tax Rate field.

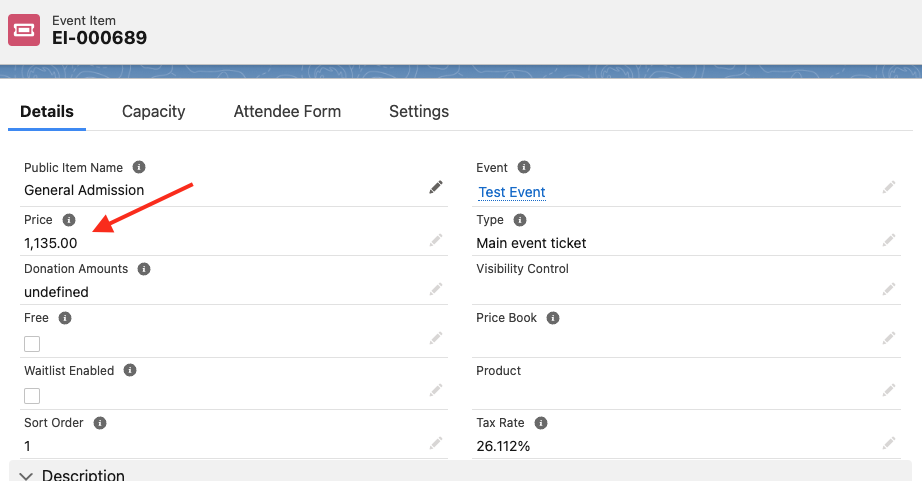

- Enter the total amount after taxes in the Event Item Price field.

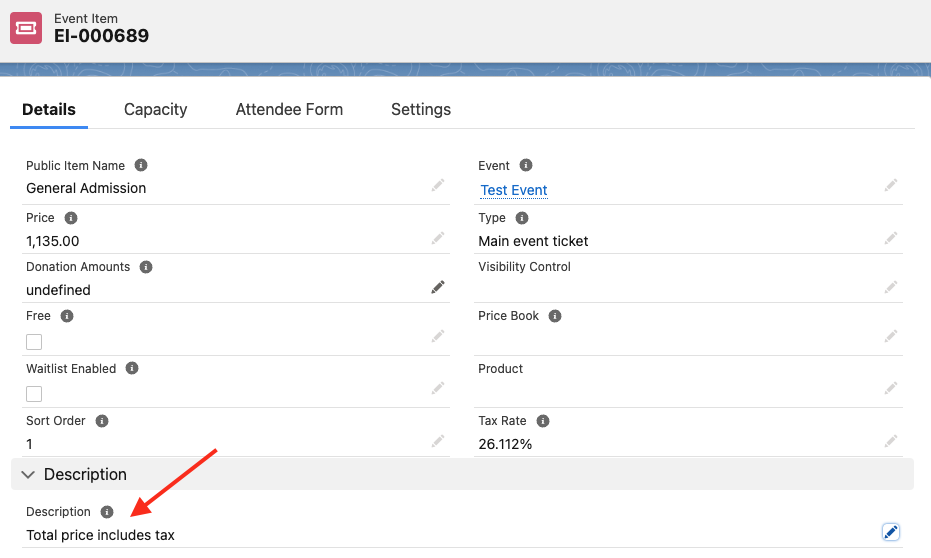

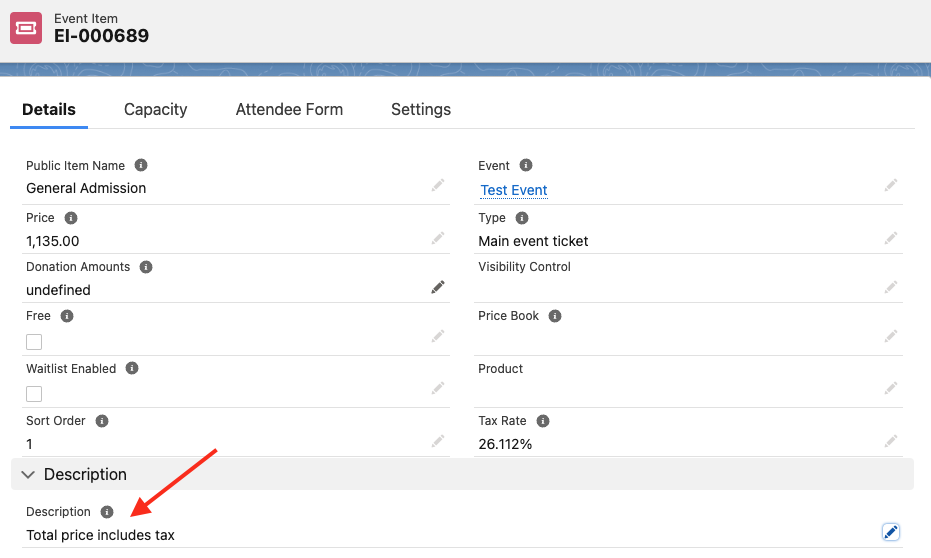

- Enter “Total price includes tax.” in the Event Item Description field.

- The Attendee will see that the total price includes tax during checkout.

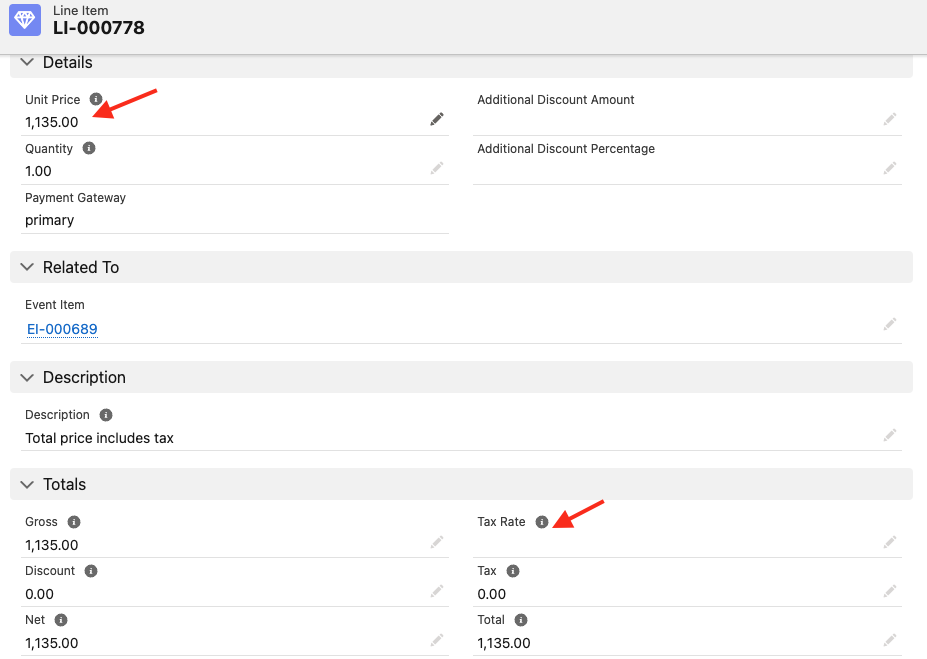

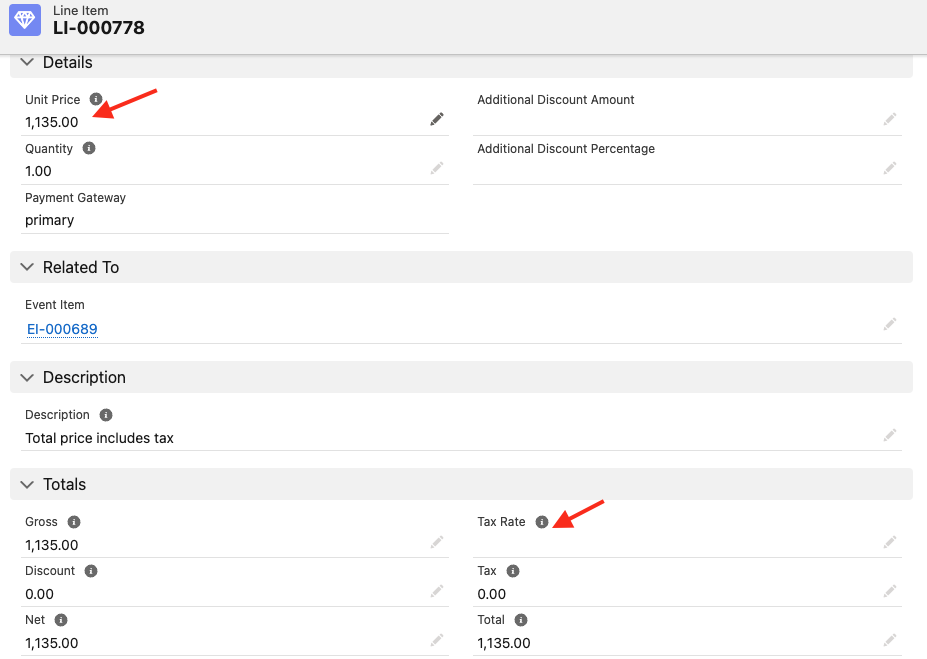

- Since the Invoice’s Line Item doesn’t show the tax rate, use a flow to override the Line Item Tax Rate field with the related Event Item values.

- Include the following steps in the flow.

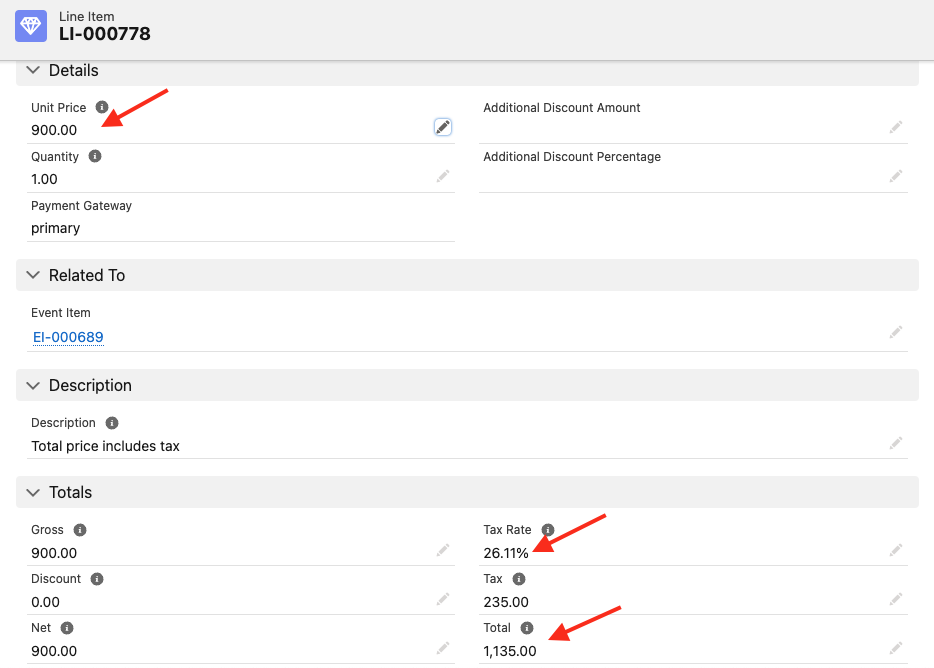

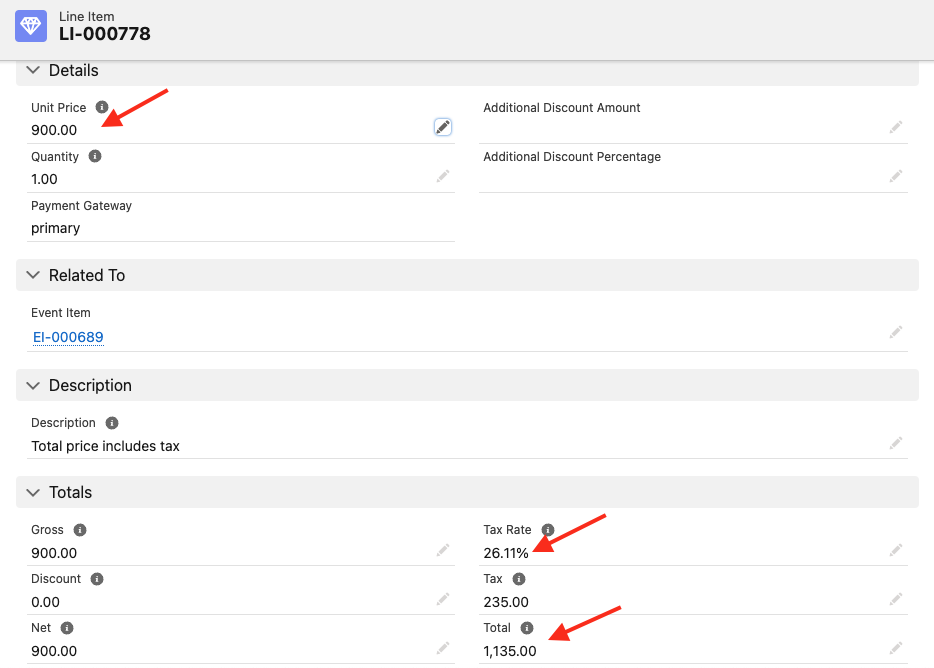

- Reference the related Event Item to grab the pre-tax Event Item Price ($900) and update the Line Item Unit Price.

- Grab the Event Item Tax Rate (26.1112%) and update the related Line Item Tax Rate field.

- The result should look like this.

- The DocumentLink's Invoice will now include the tax in the total amount due.

.png)